What is spread?

Table of Contents

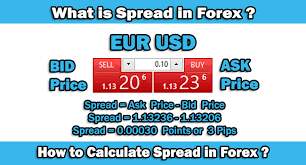

Spread is the difference between bid price and asking price. In which the bid price is the floor price offering to buy, which means the bid price of the trader . And asking price is the floor price offering for sale and is the price at which the trader will match the buy order . Now, we will check Exness spread review.

Spread calculation formula

Spread = Asking price – Bid price

Spread is measured in Pips

For most regular currency pairs, the pip will be calculated from the 4th decimal and the 2nd less number (pairs with JPY)

Exness gives traders the best spread

Exness bring to traders the most competitive spread in the market and it is suitable for many different trading styles.

In many trading floors for small brokers, Exness is my highest rating. They provide the broker good condition to trade and have a secure trading environment. One of special thing of Exness is low Spread. This is my experience when I working in a lot of trading floors after many years. Now we will go to find out about Exness’s account types including Standard, Standard Cent, Pro, Raw Spread, and Zero.

Exness spread review

Cent account

This is an account for those who are new to the Forex market in Exness. The minimum deposit is only $ 1, you will receive an account of 100 cents to open multiple lots of 0.01 lot cents ($ 0.0001 lot $). Cent accounts are mainly for trying out strategies and practice for new people, because the traders here don’t exchange much money. However, the exchange still has to treat them as normal traders and provide all conditions for them to trade like on a dollar account ($). Therefore, the spread level of this account type tends to be higher. However, that was not the case for Exness. The difference is only 0.3 pips, quite low. The most popular currency pair, EUR / USD, is only charged about 1 pip. Compared to standard accounts of other exchanges, this spread is much lower. The stopout warning level is 30% and the stopout level is 0%.

If you are the newbie and want to try with real money you should first start with a Cent account as it will help you avoid big losses initially.

Standard account

Traders use this kind of account to trade mostly in the world of trader because of its popularity and low minimum deposit 1$. Unlimited leverage is one the big advantages of Exness, it facilitates traders to plan their strategies for trade which needs high leverage and lots of currency pairs. The EUR/USD pair has a disparity approximately 1 pip and for the others common pairs, they has a lower Spread rate. Especially for Cryptocurrencies (digital money) such as Bitcoin, Litecoin, ETH, together with Mini account, traders won’t be charged any fee from Exness and can trade 24/7 except on Saturday and Sunday when the market (bank) is closed. Stop-out warning is 30% and stop-out rate is 0%.

Pro account

With instant execution mechanism, your auction will be completed in the shortest time without paying any extra commission fee. But the Spread rate for this kind of account will be from 0.1 pip. With minimum 200$ deposit, unlimited leverage and instant execution, Pro account will very suitable for professional investors. Stop-out warning is 30% and stop-out rate is 0%.

Raw Spread Account

This kind of account has the lowest Spread rate about 0.0-0.3 pip for main currency pairs. This Spread rate is suitable for everyone, especially for Scalping trader on the market because of the low bid/ask rate. Besides, Raw Spread Account also give traders an unlimited leverage that no others can give to them. But you will have to pay an extra commission fee per lot, 7$, and for all currency pairs and the minimum deposit is 200$. Stop-out warning is 30% and stop-out rate is 0%. Traders who like to trade with low Spread rate should choose Raw Spread Account.

Zero Account.

Zero Account is quite similar to Raw Spread account. The minimum deposit is also 200$ and unlimited leverage. But the thing that makes Zero account different from Raw Spread account is the commission fee, which has distinct fee for each currency pairs with the minimum for each lot is 7$, and Exness will insure your Spread rate is fixed at 0.0 pip most of the time very suitable with scalp-style trader. Stop-out warning is 30% and stop-out rate is 0%.

Thank you read Exness spread review !

You can check out the current spread on Exness by clicking this link.

[…] types: Raw Spread, Standard, Zero account and Pro account,…. Exness is the forex broker that has the lowest swap, […]